By Robert Cunningham, Angelswin.com Senior Writer

Edited by Chance Hevia (Inside Pitch) and Jason Sinner (Dochalo)

As I said in the final installment of the Trade Deadline Series, the only substantive path moving forward from the 2017 Trade Deadline through the end of 2020 is contending over the next 3 1/2 seasons of Mike Trout’s current contractual control.

Nothing else matters.

This does not mean that we do not plan beyond 2020 or that we sacrifice everything now for this 3-year period but it does mean a laser-like focus on winning in that time frame. It is my belief that Billy and Arte fully understand this.

That is why, near the end of August, Eppler invested in the team by acquiring Justin Upton and Brandon Phillips at a pretty reasonable cost. It was a calculated gamble to win now, with Mike Trout, that did not work out.

The move even had a hint of brinkmanship and shrewdness to it, on Eppler’s part, because if Upton leaves we only paid a small pittance for a 1-month rental but if he stays the Angels have finally filled the gaping hole in left field, long-term, and, guess what, Justin signed a new 5-year deal at a fair market rate.

Winning in the Mike Trout window while re-positioning and re-tooling the team around him will take some crafty maneuvering, bold moves, and a commitment by Moreno to open the pocketbook when the time is right to ensure that the extra money he dolls out will be minimized and applied intelligently, not wasted.

As I outlined in the Finances section, the Angels have a lot of free payroll space this off-season. In fact they have enough space this year to afford to not exceed the Competitive Balance Tax (CBT) threshold. It is unnecessary, this year, even if they take on a big contract.

However if the Angels do want to dole out some extensions to specific key players while demonstrating to Mike Trout that they can and will compete in the future, in order to sway him to sign a mega-extension, they will need to de-conflict their strong desire to compete over the next three years with the reality that payroll will rise in 2019 and 2020, primarily due to rising arbitration costs.

The only probable way to mitigate that conflict, barring a series of brilliant moves by Billy Eppler, will be for Arte Moreno to authorize a brief increase in team payroll that takes us over the CBT threshold in 2019 and 2020 or 2020 and 2021 to help acquire the assets the Angels will need to make a strong run over the next three seasons.

In fact this year or next may be that moment where Arte allows Billy Eppler to exceed the Luxury Tax for that “right player” Moreno has spoken about in the past.

Based on the new CBT thresholds and rules and the fact that the Angels would be a “first-time offender” if they eclipse the Luxury Tax, Eppler could trade for a big name player, with 3 or more years of control, this off-season or sign one to a long-term, front-loaded deal, with one or more opt-out’s after 2020, next off-season (i.e. likely controlling them for no more than 2-3 years). This type of move would unlikely hurt team payroll in the long-term and would increase the odds of winning in the Mike Trout window of contention.

In either scenario, striking this off-season or next, the Angels could exceed the CBT threshold in 2019 ($206M) by up to, likely, $40M which would incur a first-year penalty of up to $10.4M if they hit the, plausible, maximum ceiling of $246M in AAV.

A second year would incur upwards of a $14.4M penalty for the 2020 season as long as they do not exceed the Luxury Tax threshold by more than, the aforementioned, $40M. After that it would be probable that the big-name trade target or free agent in question would opt-out and the Angels would be out of the penalty box.

To be clear it is probable that Arte Moreno has never contemplated a payroll penalty of this magnitude since he bought the team. In fact he has consistently kept payroll in a fairly tight range from season to season even as the total expenditures rose without ever going over the CBT threshold except for that one time, for a minuscule amount, over a decade ago.

However when you consider the debt-free status of the team, the large television contract that was signed years ago worth $150M per season ($3B total over 20 years), and the partial controlling share they have in the network, there is certainly some reason for optimism, based on Moreno’s own words, that if the stars align, the Los Angeles Angels will take that calculated risk and leap into budget-busting territory for a short spell.

That decision to push all-in on a top-tier player will certainly require the right confluence of circumstances to even happen and it is very unlikely the Angels will stay above the CBT threshold for longer than a 2-year period, maximum, to avoid serious penalties under the new CBA.

If the Angels exceed the Luxury Tax threshold of $206M in 2019 they will either do it by no more than $20M or no more than $40M because the new CBA extracts additional surcharge penalties at those two separate tiers. For reference here is the relevant section from the new CBA:

So it seems realistic that Arte could authorize an increase in the 2018-2019 or 2019-2020 off-season for a two-year span covering the 2019 and 2020 or 2020 and 2021 seasons.

For instance if they go over less than $20M in 2019 they will pay 20% and if they continue to go over in 2020 they pay 30% whereas if they go up to $40M over they will pay 32% and 42%, respectively, for the difference in how much they exceed the $20M threshold mark.

The real danger with the Luxury Tax is when you become a third-time offender or exceed the CBT threshold by more than $40M. The taxes increase significantly and the club can have its Rule IV draft position impacted too. It seems very likely that the Angels would avoid becoming a third-time offender, at all costs.

Also, to be clear, the Angels do not have to exceed the CBT threshold by a lot to achieve their goals.

For instance the Angels could, this off-season, execute the following transactions:

- Trade Kole Calhoun, Jahmai Jones, Matt Thaiss, Kaleb Cowart, Wade Wass, and Jonah Wesley for Giancarlo Stanton, Dee Gordon, Jose Urena, and $24M in cash

- Trade C.J. Cron, Chris Rodriguez, and Taylor Ward for Brandon Belt

- Extend Garrett Richards (6 years, $90M), Martin Maldonado (5 years, $35M), and Tyler Skaggs (5 years, $35M)

- The team would still have top prospects like Jordon Adell, Brandon Marsh, Jaime Barria, Jose Suarez, Griffin Canning, and Jerryell Rivera, as well as potential solid role players like Michael Hermosillo, Leonardo Rivas, and Jake Jewell among others

- Actual payroll would be approximately $192M and AAV would be approximately $188M ($9M under the CBT threshold)

In the following 2018-2019 off-season the Angels could also do the following:

- Extend Mike Trout (12 years, $500M) and Andrelton Simmons (7 years, $119M)

- Trade Matt Shoemaker and J.C. Ramirez for prospects (one likely being a MLB ready 3B prospect)

- Decline Valbuena’s option year

- Actual payroll would still be about $192M and AAV would be right at the threshold of $206M

- If the Angels needed more payroll room at the Trade Deadline in 2019 Moreno could authorize an increase over the CBT threshold as needed and the penalty would be, at most, $4M as long as the team does not go over the CBT threshold by more than $20M

This is just an example of the types of moves the Angels can make with their newfound payroll space. It also relies on paying the extension candidates a little less money in 2018, 2019, and 2020 and moving some of that salary out to the 2021+ time frame. However after 2021 Pujols comes off the books and essentially cancels the impact of this salary distribution.

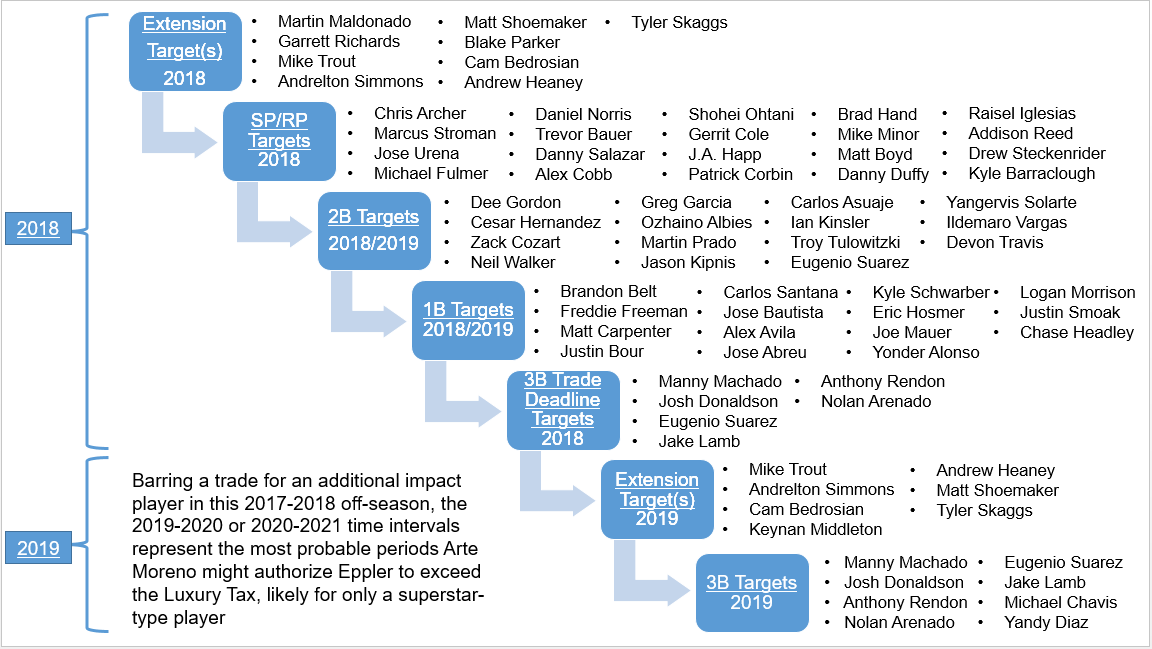

As we said in the Strategy sections (Part I and II) there are so many permutations and paths for how the season can unfold that it is difficult to guess the particulars. Here is a more generic template (you can fill in your own guesses as you prefer) that the Angels may be operating on:

In the end it is my personal belief Eppler and Moreno are gearing up for a big run over the next three years as they should be doing. No prospect is safe and some of our low and mid-end regulars could be on the block too.

Imagine and prepare for the Angels to part ways with at least one or more of their top prospects to acquire the high-end regulars they need to start the season or to upgrade for at the trade deadline to make a strong run at the playoffs over the next 2-3 years.

Why keep Adell if you can package him up with other players and prospects to get a front-line starter like Archer? Pairing Chris with a newly extended Richards over at least the next four years would give the Angels strong production and a 1-2 punch in the playoffs without seriously damaging team payroll.

Alternatively, why keep Jones if you can package him with Calhoun and potentially nab a really top-flight outfielder like Stanton? The Angels would wind up with perhaps the greatest outfield trio to ever play the game for the next three seasons and we would still have prospects like Jordon Adell and Brandon Marsh that could fill a potential void after 2020.

If the Angels extend Maldonado is Ward really that important to keep if you can package him up with C.J. Cron and Chris Rodriguez for four years of a solid hitting 1B like Belt? Brandon would be a great lead-off or two-hole hitter in front of Mike Trout and the Angels would still have other reasonable back-up catching options behind the dish moving forward.

Of course the Angels can avoid parting with any prospects and go after superstar Japanese player Shohei Ohtani as we discussed in Eppler’s Strategy section (Part II) of the Primer Series (note just as this went to publication the O.C. Register’s Jeff Fletcher reported that the Angels do have interest in signing him).

Certainly depth is very important, so I am not advocating laying waste to our Minor League assets, but certainly there are areas of strength in our farm system such as outfield and pitching of which Eppler can draw upon to execute some needed trades to improve the team today, not tomorrow.

Adding a big name like Giancarlo Stanton (high salary, medium prospect cost), Chris Archer (very low salary, high prospect cost), or Shohei Ohtani ($20M posting fee plus a couple of normal pre-arbitration salaries with a probable long-term, high salary extension contract) would probably have the greatest immediate impact. Alternatively signing or trading for more than one above-average player like Zack Cozart and Trevor Bauer could provide a similar but more dispersed value to the team.

Moves like these would allow the Angels to start off the season from a great base and move toward the Trade Deadline with a likely, stronger posture. Once they hit the deadline there is a reasonably good chance the Angels can upgrade at 3B, SP, or RP, as needed, with names like Machado, Donaldson, Happ, Gonzalez, Harvey, Britton, Kimbrel, Miller, and Allen potentially available.

On the off-chance Eppler is priced out of the trade and free agent markets for his preferred choices, this off-season, he can still upgrade at 2B and/or 1B to compete effectively in 2018 and wait for the 2018-2019 off-season to make a run at some of the bigger names that will be available next year at this time.

A simple example might be acquiring Ian Kinsler to play 2B and signing Logan Morrison to man 1B. Both would be short-term commitments that could bridge the gap to 2019 where the Angels could find reduced asking prices on players at those positions or focus on one of the marquee names like Machado.

It is not completely unreasonable to believe that the Angels could sign a guy like Manny to a mega-deal but front-load the contract heavily in the first two years (2019 and 2020) and then give him an opt-out after 2020 (or even two opt-outs, one after 2020, the other after 2021). By putting a lot of salary in those first two seasons you make it a near certainty that he would opt-out after 2020 and would pull the team back below the Luxury Tax threshold. This type of contract is increasingly more common in baseball.

Ultimately, if you are a fan of rebuilding farm systems, this may, in my humble opinion, be a potentially painful two years for you. The good news is that although we are about to expend at least some of our prospect capital we will also be restocking some of it over the same time frame, via the Rule IV draft, and when we finally do need it in the 2020-2021 range some of them should be ready to step into the fold.

Also one final detail. Many of these bigger names we could potentially pick up can also be traded in their last year of control, likely netting a reasonably healthy return in prospects.

So for instance if Upton stays for the next four years we could always move him in trade in the 2020-2021 off-season or at the deadline in 2021 for a decent return that will help restock our system. Losing a good prospect now could, in part, be made up for at a later date.

The final caveat to the entire Primer Series is that I once wrote, two years ago, that Moreno would and should open his wallet to pick up a big name outfielder and I was proven wrong.

I could easily be proven wrong here, as well, but the timeline makes too much sense with the Angels staying below the Luxury Tax threshold this year then potentially exceeding it, even if only by a mild amount, for a 2-year window through the end of Mike Trout’s current contract.

This time I really hope that I am right.

Add The Sports Daily to your Google News Feed!